capital gain tax malaysia

In order to calculate the capital gains tax the taxpayer will need to fill in the following details. Pensions property and more.

Capital Gains Losses From Selling Assets Reporting And Taxes

Elon Musk plans to lay off most of Twitters workforce if and when he becomes owner of the social media company Elon Musk plans to lay off most of Twitters workforce if and when he becomes owner.

. As mentioned above we can deduct the exemption waiver. Formally a string is a finite ordered sequence of characters such as letters digits or spaces. The long-term capital gains tax rate is 0 15 or 20.

Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. For instance it is good to know that the dividends of companies in Malaysia are not taxed which is why shareholders can enjoy the 100 share profit. On the other hand long-term capital gains are taxed at a rate of 20 percent.

The net benefits of human capital flight for the receiving country are sometimes referred to as a brain gain whereas the net costs for the sending country are sometimes referred to as a brain drainIn occupations with a surplus of graduates immigration of foreign-trained. Latest news expert advice and information on money. WTOP delivers the latest news traffic and weather information to the Washington DC.

One can make use of capital gain income tax computation in a very simple and hassle-free way in order to determine the capital gain that has been made on the sale. Under the Section 11A on the Income Tax Act equity and equity shares funds that have been sold in stock exchange and securities transaction tax on such short-term capital gains is chargeable to tax at a rate of 10 percent up to 2008-9 and 15 percent from 2009-10 onwards. Net Chargeable Gain Chargeable Gain - Exemption Waiver RM10000 or 10 of Chargeable Gain whichever is higher RM190000 - RM190000 X 10 RM171000.

How long you owned the asset. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year also known as a long term investment. The type of asset Special rates apply to particular types of assets Your income Higher income taxpayers face higher capital gain tax rates Your taxable income This may also trigger liability for the new 38 percent net investment income NII Medicare tax.

A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset. Get the latest international news and world events from Asia Europe the Middle East and more.

Fraud alert text appearing to be from your bank will get your attention but it could be a scam. Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. Corporate tax individual income tax and sales tax including VAT and GST and capital gains tax but does not.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. Morgan Stanley helps people institutions and governments raise manage and distribute the capital they need to achieve their goals. Now we move on to the net chargeable gain.

If you are selling a property you should know that any profit made from the sale is potentially considered a capital gain and therefore. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax.

What is capital gains tax. Malaysia used to have a capital gains tax on real estate but the tax was repealed in April 2007. Intellectual capital does not affect a company stocks current earnings.

Investment Banking Capital Markets. A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchaseSo if you sell a property for more than you paid for it thats a capital gain. Whether you had a gain or a loss on the sale.

We have global expertise in market analysis and in advisory and capital-raising services for corporations institutions and governments. Japan Last reviewed 08 August 2022 Capital gains are subject to the normal CIT rate. The list focuses on the main types of taxes.

See todays top stories. The Jerusalem Post Customer Service Center can be contacted with any questions or requests. From the example we can see that the client ended up saving a total of 150746 in capital gain tax just from including the capital improvements captured in their Duo Tax Capital Gains Report.

Transfer tax at 2 on transfers of Jamaican real estate and securities. Human capital flight is the emigration or immigration of individuals who have received advanced training at home. It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10000.

Except for gains arising from the disposal of real property situated in. The taxation of dividends in. Intellectual capital contributes to a stocks return growth.

Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset. However a real property gains tax RPGT has been introduced in 2010. In recent years economic theory has moved towards the study of economic fluctuation rather than a business cycle though some economists use the phrase business cycle as a convenient shorthand.

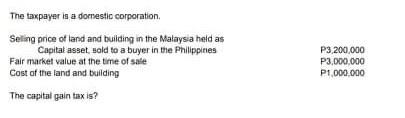

No capital gain tax regime. The empty string is the special case where the sequence has length zero so there are no symbols in the string. While the Capital Gain Tax is imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in.

People who choose to do business in Malaysia can benefit from the interesting opportunities on the market and from the incentives and advantages that come with the taxation system in the country.

List Of Countries By Tax Rates Wikipedia

5 Countries With No Capital Gains Taxes By Gareth Mcgray Medium

Thewall Profited From Trading Bitcoin Find Out If You Need To Pay Taxes The Edge Markets

Capital Gains Tax Hi Res Stock Photography And Images Alamy

9 Expat Friendly Countries With No Capital Gains Taxes

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

Proper Economic And Distributional Analysis Needed If Capital Gains Tax Is To Be Introduced Say Micpa And Deloitte The Edge Markets

What Are The Various Exemptions From Cg And How Are Capital Gains Of Non Residents Taxed In India Youtube

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

Solved The Taxpayer Is A Domestic Corporation Selling Price Chegg Com

Tax And Investments In Malaysia Crowe Malaysia Plt

Gl Property Consultancy Real Property Gains Tax Rpgt Is A Form Of Capital Gains Tax That Homeowners And Businesses Have To Pay When Disposing Of Their Property In Malaysia This Means

Tax Experts No Need For Capital Gains Inheritance Taxes

Real Property Gains Tax In Malaysia How Is It Calculated

Capital Gains Tax Australia Property Investment Uk Property Investment Csi Prop

Real Property Gains Tax Rpgt In Malaysia 2022

The Best Capital Gains Free Countries For Forex Trading Business Review

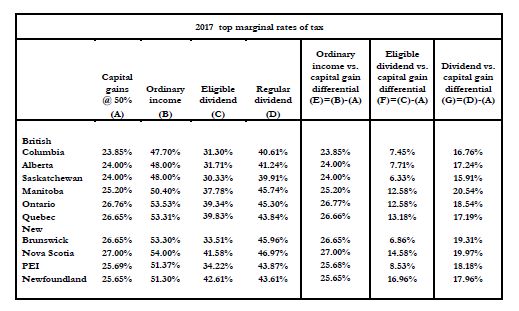

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

0 Response to "capital gain tax malaysia"

Post a Comment